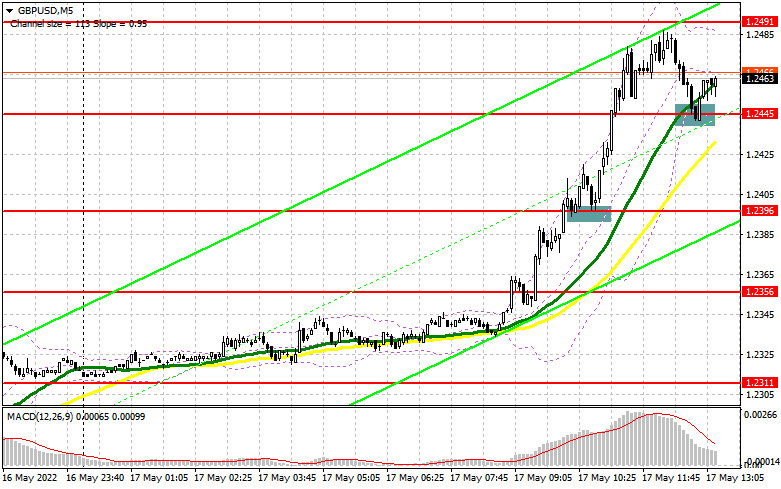

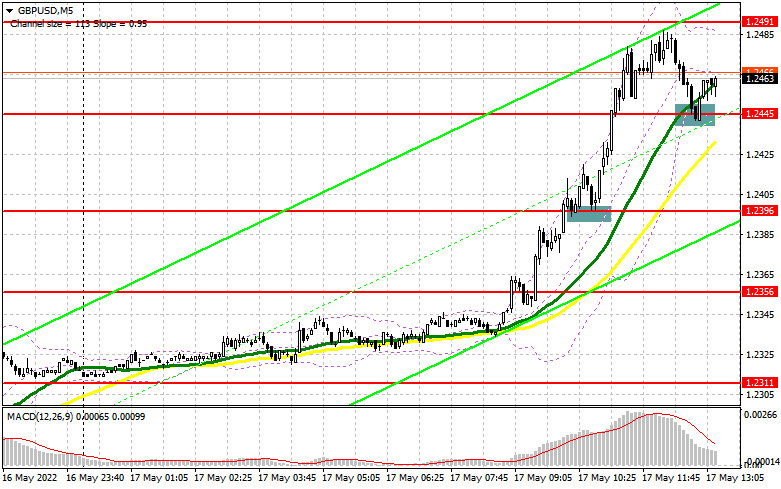

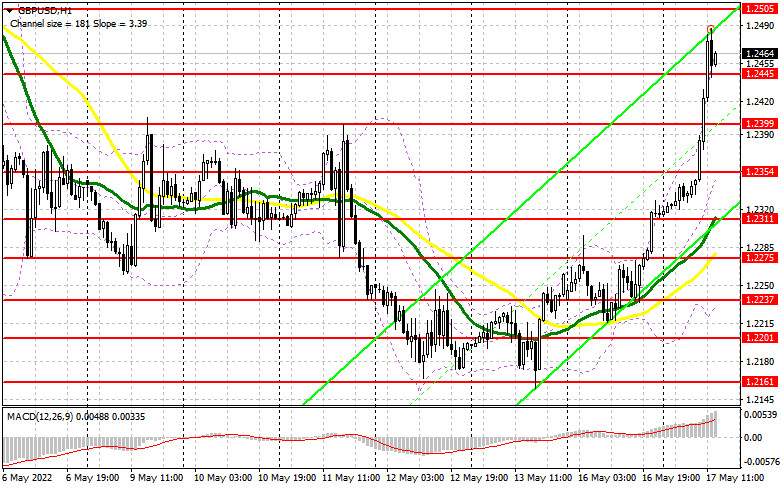

The British pound has made one of the strongest upward spurts in recent times. In my morning forecast, I paid attention to the level of 1.2396 and 1.2445 and recommended that they make decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. A decrease in the number of unemployment claims and a sharp increase in the level of average earnings in the UK have become catalysts for the growth of the British pound on the eve of important reports on the American economy. A breakout and a reverse test from top to bottom gave a signal to open long positions in the expectation of continuing the upward correction, which led to a breakdown of 1.2445 and an increase to the area of 1.2491, showing an upward movement of more than 90 points. The reverse top-down test of the 1.2445 level at the time of writing allowed us to get an additional buy signal, which has already shown an upward movement of 35 points. In the afternoon, the technical picture changed slightly. And what were the entry points for the euro this morning?

To open long positions on GBP/USD, you need:

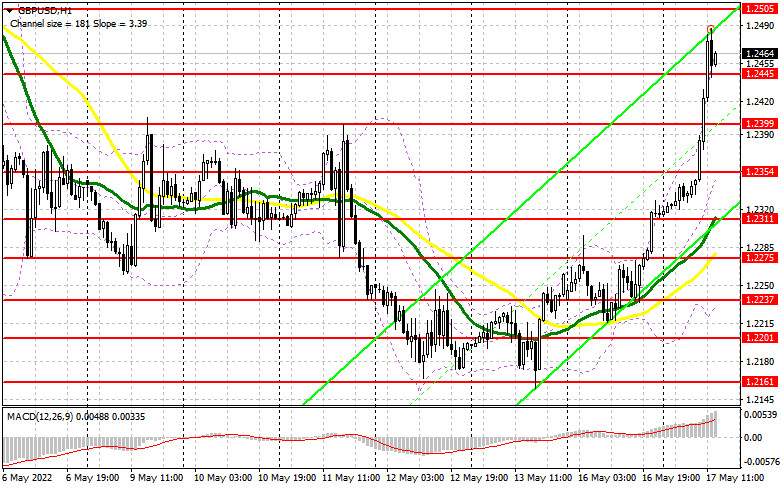

While trading will be conducted above 1.2445, we can expect further growth of GBP/USD according to the newly formed trend. However, do not forget that we have data on retail sales in the United States for April of this year ahead of us. Weak figures will indicate a likely decrease in inflationary pressure, which will ease pressure on the Federal Reserve System and reduce demand for the US dollar, returning investors' appetite for risk - an additional signal to buy the British pound. Also in the afternoon, there will be speeches by Chairman of the Fed Board of Governors Jerome Powell and his colleagues in the role: FOMC member James Bullard and Patrick T. Harker. Their statements may lead to a surge in volatility, although, as we can see on the chart, the market seems to have chosen the right side for it. If the pressure on the pound returns after the data, I advise you to focus on the nearest support of 1.2445, which has already worked itself out in the first half of the day. Therefore, only the formation of a false breakdown there will lead to a new signal to open long positions in the expectation of growth to the resistance of 1.2505 - a new level that I had to revise after the morning movement of the pound up. It is possible to expect a sharper spurt of the pair, but only after weak statistics on the United States. Fixing above 1.2505 with a reverse test from top to bottom, by analogy with those that I just disassembled - all this will lead to a buy signal followed by movement to the area of 1.2574. I recommend fixing profits there. The more distant target will be the 1.2633 area. In the case of a decline in the pound and the absence of buyers at 1.2445, and most likely it will be, given that bulls can start taking profits after such a rally, I advise you not to rush into purchases. It is best to enter the market after a false breakdown at 1.2399. You can buy GBP/USD immediately on a rebound from the minimum of 1.2354, or even lower - around 1.2311 and only to correct 30-35 points within a day.

To open short positions on GBP/USD, you need:

If you look at the chart, then in the current realities, only the protection of 1.2505 will help the bears somehow rehabilitate themselves, which will lead to a downward correction and the pair will return to the 1.2445 area. Strong US data and a false breakdown at this level will be an excellent setup for opening short positions with the expectation of a breakthrough and consolidation below 1.2445. A breakout and a reverse test from the bottom up of this range form an additional sell signal capable of collapsing the pound to 1.2399, where I recommend fixing the profits. A more distant target will be the 1.2354 area, the test of which will cast doubt on the further growth of the pair in the next couple of days. It is possible to hope for the implementation of this scenario only after the speeches of the Fed representatives and their more hawkish statements regarding interest rates and future monetary policy. With the option of GBP/USD growth and lack of activity at 1.2505, another upward jerk may occur against the background of the demolition of stop orders. In this case, I advise you to postpone short positions until the next major resistance of 1.2574. I also advise you to open short positions there only in case of a false breakdown. You can sell GBP/USD immediately for a rebound from 1.2633, counting on the pair's rebound down by 30-35 points within a day.

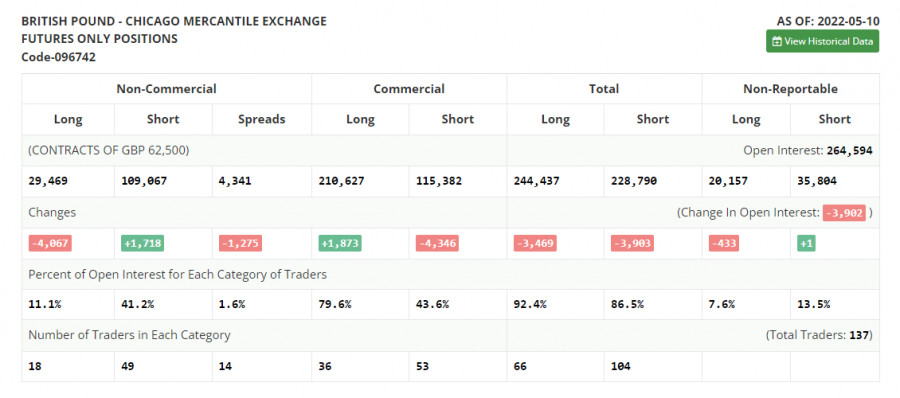

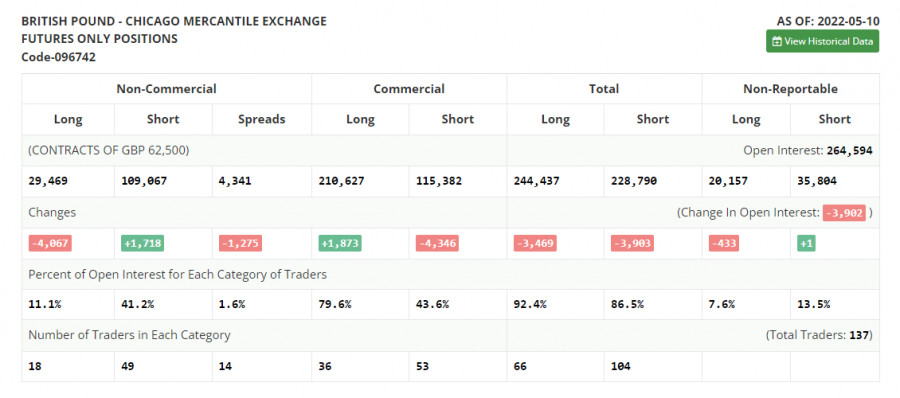

The COT report (Commitment of Traders) for May 10 recorded a reduction in long positions and another increase in short ones, which led to a further increase in the negative delta. The presence of several problems in the UK economy and a rather difficult situation with inflation is forcing investors to get rid of the British pound, which is very seriously losing its attractiveness against the background of demand for safe-haven assets and more profitable instruments. The monetary policy of the Federal Reserve System aimed at tightening the cost of borrowing will continue to support the US dollar, pushing the British pound lower and lower. The actions of the Bank of England to raise interest rates have not yet brought the proper result, and talk that due to serious economic difficulties, the regulator may suspend the normalization of monetary policy altogether frightens investors even more. As I have repeatedly noted, future inflation risks are now quite difficult to assess also due to the difficult geopolitical situation, but the consumer price index will continue to grow in the coming months. The situation in the UK labor market, where employers are forced to fight for every employee by offering higher and higher wages, is also pushing inflation higher and higher. The COT report for May 10 indicated that long non-commercial positions decreased by -4,067 to the level of 29,469, while short non-commercial positions increased by 1,718 to the level of 109,067. This led to an increase in the negative value of the non-commercial net position from the level of -73,813 to the level of -79,598. The weekly closing price decreased from 1.2490 to 1.2313.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 daily moving averages, which indicates the continued growth of the pound.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of a decline, the average border of the indicator in the area of 1.2354 will act as support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.